Addressing the emotional side of money.

I’m not just about the numbers. I’m about creating meaning behind the numbers.

My path to financial education was an unexpected one, as my background is in psychology and storytelling.

However, in 2015 I lost a parent unexpectedly which left me, my mother, and sibling drowning in grief and financial anxiety.

School never taught me how to be an adult with money.

When I did try to seek out financial education and guidance, every single person I met with was a white dude in a grey suit that had no idea how to address my financial life as a first generation queer femme person. The human aspect and emotional weight that money can carry was met with dismissiveness and each meeting I had was incredibly *yawn* dry and boring.

I wanted to find someone like me but the white cishet patriarchy that wreaks havoc in the financial industry left me running in circles. I got tired of running.

From this experience, I made it my absolute mission to turn my grief into gold and teach myself all that there is to know about money; not just the literacy, but how it shows up in our body, mind, heart, and spirit.

I am a certified Trauma Of Money facilitator and soon to be Certified Financial Education Instructor (CFEI), with over seven years of experience in the fintech and wealth advocacy space.

WHEN I’M NOT BEING A FINANCIAL BAD ASS, YOU’LL FIND ME

😎 Roller skating.

🎮 Gaming.

🤯 Moshing at hxc shows.

🤬 Yelling profanities at underground wrestling matches

🙃 I am also a pretty big nerd and say “hella” and “dude” a lot.

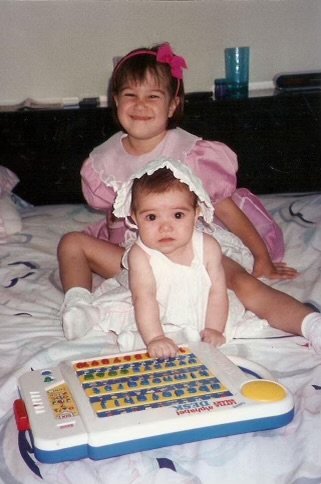

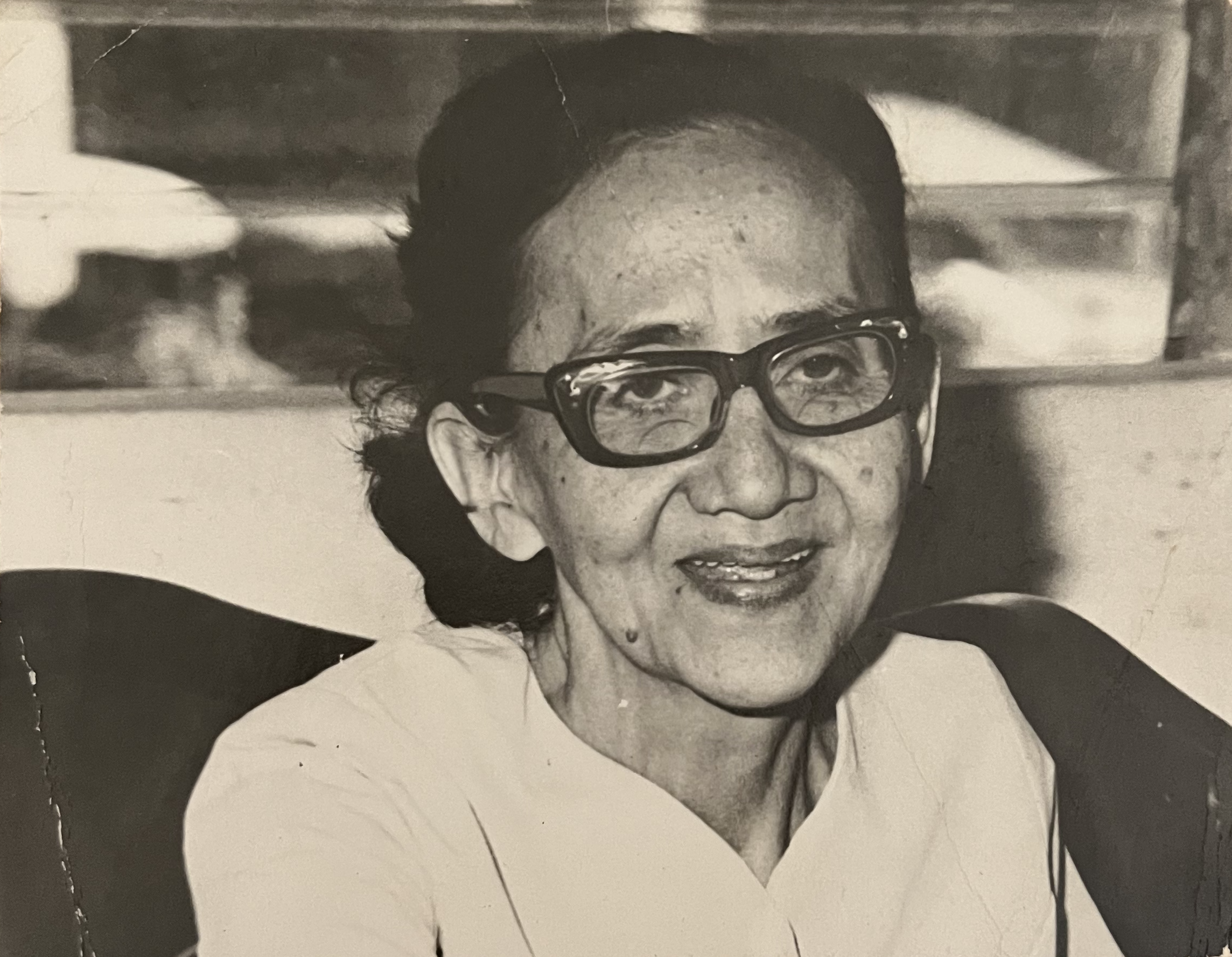

It is no accident that on this journey, I unraveled something entirely new about my ancestors, specifically my Lola Nanay (translated as grandmother):

abundance is in my blood

My Lola was the matriarch of her family. She managed all the finances for her family and even for the university and a politician.

My Lolo Taytay was once upon a time, a wealthy man and came from a wealthy family, owning a well known mango farm. I had only heard tales of poverty, scarcity, and suffering. I had no idea there was this wisdom that my ancestors were also abundant at a time.

and i stay with the facts.

37%

According to a recent survey from the Federal Reserve, thirty-seven-percent of Americans would have difficulty covering an unexpected $400 expense.

23 states

As of 2022, only 23 states require high school students to take a course in personal finance.

72%

According to a study by the American Psychological Association, 72% of Americans reported that finances are the number-one cause of stress.

I am an educator.

Nelson Mandela said, “education is the most powerful weapon.” I see the power that arises in each and every one of my clients because they are no longer in the dark of not knowing.

I believe that education is a human right, not a privilege and that financial literacy should be a part of that human right.

THAT'S WHAT INSPIRED ME TO CREATE MY SIGNATURE WORKSHOP.

Need, Want, Dream

A workshop for ALL that want to break the mystery of how to thrive.

People assume that financial literacy is just about knowing how to save, budget, and invest. Rarely do you ever hear "make more money" as a part of financial literacy. In fact, usually you hear…

“Cut out unnecessary spending!”

“Go on a cash diet!”

“Credit cards are bad!”

That’s cute. Except we have systemic issues such as the wage, wealth, and opportunity gaps in the United States where folks are just trying to make ends meet.

This is where your NEED, WANT, DREAM numbers come in. This workshop empowers QTBIPOC to reclaim their agency, determine their need, want, and dream numbers, and encourage them to find and/or create opportunities to get to where they financially need and desire to be.

Hear from kate w., a NEED, WANT, DREAM attendee:

"In our time working together, it became clear that Stella brought historical and social considerations to their advice/education."

This was a non-negotiable for me, and very appealing to me as someone who could influence programming at my place of work. Stella’s NEED WANT DREAM workshop opened the door to go deeper on the different aspects we covered:

1. the wage and opportunity gaps and how that compounds within wealth gaps.

2. The notion that even though we are suffering from systemic oppression, we still have agency in creating a path forward.

Stella carried a serene environment throughout the presentation even while our team engaged with a difficult subject.

THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT | THIS IS A PUBLIC SERVICE ANNOUNCEMENT

SPEAKING ABOUT BUILDING WEALTH IS MY JAM.

I have seen in my work what happens when a person is financially educated. They begin their path to financial liberation by making smarter financial decisions that benefit not just their financial wellbeing, but the financial wellbeing of others around them. Financial literacy is revolutionary and it is never too late to learn.